Offshore Company Formation Can Be Fun For Everyone

Table of Contents10 Easy Facts About Offshore Company Formation DescribedOffshore Company Formation Fundamentals ExplainedGetting The Offshore Company Formation To WorkNot known Facts About Offshore Company Formation

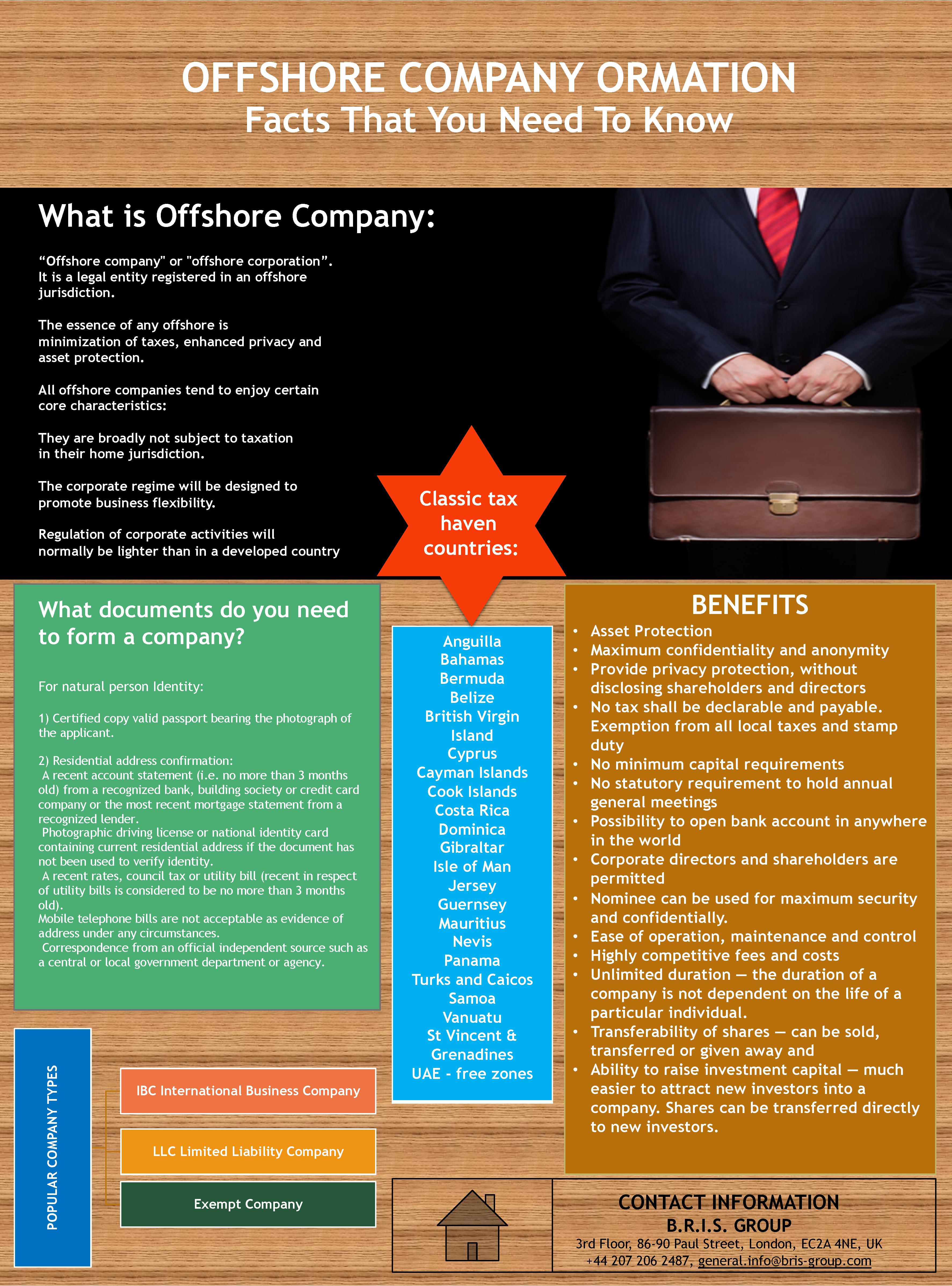

Provided all these advantages, an overseas firm development in Dubai is the most ideal sort of venture if you are looking for to realise goals and/or tasks such as any of the following: Offer specialist services, working as a consultant, and/or function as an agency Resource foreign talent/ expatriate staff Feature as a Building Having & Investment firm International profession Captive insurance Tax obligation exemption However, overseas business in UAE are not allowed to involve in the following organization activities: Money Insurance coverage and also Re-insurance Aviation Media Branch set-up Any kind of company task with onshore companies based in UAE Service Advantages Of A Dubai Offshore Company Development Outright confidentiality as well as personal privacy; no disclosure of shareholders and accounts called for 100 per cent total ownership by a foreign nationwide; no regional sponsor or partner needed 100 per cent exemption from company tax for half a century; this choice is eco-friendly 100 per cent exemption from personal revenue tax 100 percent exemption from import and re-export obligations Protection and administration of properties Company procedures can be carried out on an international level No restrictions on foreign ability or staff members No restrictions on currencies and also no exchange plans Office area is not needed Capability to open up as well as preserve bank accounts in the UAE as well as overseas Ability to invoice regional as well as worldwide clients from UAE Consolidation can be completed in less than a week Investors are not required to show up prior to authority to promote unification Vertex Global Professional supplies been experts overseas firm setup solutions to assist international entrepreneurs, capitalists, and also corporations develop a neighborhood visibility in the UAE.Nonetheless, the share resources needs to be split right into shares of equivalent small value regardless of the quantity. What are the offered territories for an overseas company in Dubai as well as the UAE? In Dubai, presently, there is only one offshore jurisdiction available JAFZA offshore. offshore company formation. Along with JAFZA, the other offshore territory within the UAE consists of RAK ICC & Ajman.

What is the duration required to start an overseas company in the UAE? In a suitable circumstance, establishing up an overseas business can take anywhere between 5 to 7 working days.

Little Known Questions About Offshore Company Formation.

The offshore company enrollment procedure should be carried out in complete supervision you can check here of a firm like us. The demand of opting for overseas firm enrollment process is essential prior to establishing a firm. As it is called for to accomplish all the conditions after that one should describe a proper association.

An is defined as a firm that is incorporated in a territory that is apart from where the useful owner lives. In other words, an offshore company is merely a firm that is included in a nation overseas, in a foreign territory. An overseas firm meaning, however, is not that straightforward and will certainly have differing definitions depending upon the scenarios.

Getting The Offshore Company Formation To Work

While an "onshore business" describes a residential business that exists and also operates within the boundaries of a nation, an offshore company in contrast is an entity that performs all of its transactions outside the borders where it is included. Because it is possessed and exists as a non-resident entity, it is not responsible to local taxation, as all of its financial transactions are made outside the borders of the territory where it lies.

Business that are developed in such offshore look at here now territories are non-resident due to the fact that they do not perform any type of economic deals within their boundaries and are possessed by a non-resident. Creating an overseas business outside the country of one's own home adds extra security that is located only when a business is incorporated in a separate lawful system.

Since overseas companies are recognized as a different legal entity it operates as a different person, distinct from its owners or directors. This separation of powers makes a difference in between the owners and the business. Any kind of actions, financial debts, or obligations handled by the business are not passed to its supervisors or participants.

What Does Offshore Company Formation Do?

While there wikipedia reference is no solitary standard by which to gauge an overseas firm in all offshore territories, there are a variety of qualities and distinctions one-of-a-kind to specific financial centres that are thought about to be overseas centres. As we have claimed due to the fact that an offshore business is a non-resident and conducts its transactions abroad it is not bound by neighborhood company tax obligations in the nation that it is included.

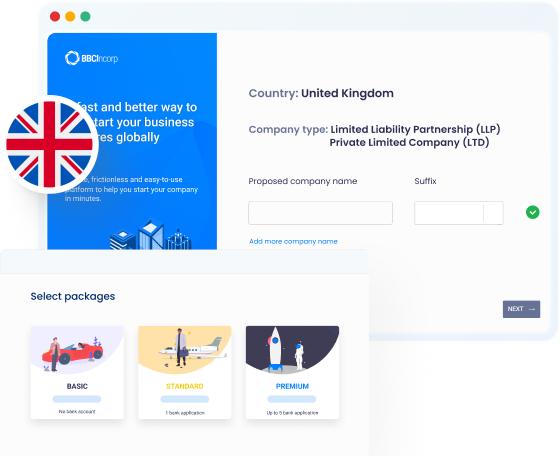

Traditional onshore countries such as the UK and US, commonly seen as onshore economic facilities really have offshore or non-resident business policies that enable international business to incorporate. These corporate structures likewise are able to be devoid of neighborhood taxes although ther are developed in a normal high tax onshore environment. offshore company formation.

For additional information on discovering the finest nation to develop your offshore firm go right here. Individuals as well as companies pick to develop an overseas business primarily for a number of reasons. While there are differences in between each offshore territories, they often tend to have the following resemblances: Among the most engaging reasons to use an overseas entity is that when you make use of an overseas corporate structure it divides you from your company in addition to possessions as well as obligations.